Become a US Tax Consultant

Internal Revenue Service

Become a Tax Expert of America

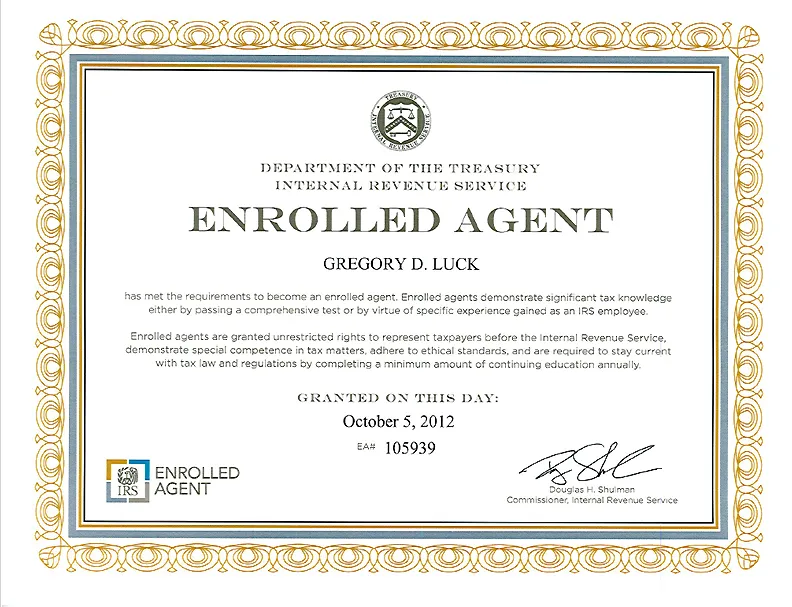

Highest Tax Credential awarded by Internal Revenue Service (IRS)

300+ hours of live training

6 – 9 months of completion period

Learn from US Tax Consultants

300+ hours of pre-recorded class and self-learning platform

Learn with your recruiters

Placement Training and Internship Opportunity

Faculties with corporate experience

An enrolled agent is a person who has earned the privilege of representing taxpayers before the IRS or Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns, or through experience as a former IRS employee.

Register for a FREE Demo Class Today

April, 2024

July, 2024

June, 2024

Working Professional Batch

Preliminary Work, Taxpayer Data (17 questions)

Income and Assets (21 questions)

Deductions and Credits (21 questions)

Taxation and Advice (14 questions)

Specialized Individual Returns (12 questions)

Business Entities (28 questions)

Business Financial Information (39 questions)

Specialized Returns and Taxpayers (18 questions)

Practices and Procedures (25 questions)

Representation before the IRS (24 questions)

Specific Types of Representation (19 questions)

Completion of the Filing Process (17 questions)

3.5 hours – 100 multiple-choice questions

Exam Window : May 1st - Feb 28

3.5 hours – 100 multiple-choice questions

Exam Window : May 1st - Feb 28

3.5 hours – 100 multiple-choice questions

Exam Window : May 1st - Feb 28

You must meet each prerequisite listed below in order to be an Enrolled Agent :

An enrolled agent is a person who has earned the privilege of

representing taxpayers before the Internal Revenue Service.

Enrolled agents, like attorneys and certified public accountants

(CPAs), are generally unrestricted as to which taxpayers they

can represent, what types of tax matters they can handle, and

which IRS offices they can represent clients before.

Follow these steps to become an EA:

1. Obtain a Preparer Tax Identification Number

2. Apply to take the Special Enrollment Examination (SEE)

3. Achieve passing scores on all 3 parts of the SEE

4. Apply for Enrollment

5. Pass a suitability check, which will include tax compliance

to ensure that you have filed all necessary tax returns and

there are no outstanding tax liabilities; and criminal

background

Each part takes 3.5 hours and has 100 multiple-choice questions (MCQs). After each part of 50 MCQs, there is a 15-minute break. As soon as the test is over, results are posted online so that students can print them.

BCom, BBA, MCom, and MBA graduates who want to work closely with US teams and clients and build a job in US taxation can take this course.

PTIN stands for Preparer tax identification number. It can be applied at any time during the year, and it should be updated every year.

With the PTIN application, you have to submit a coloured copy of

your passport that has been notarized. When it comes to

notarization, keep in mind the following:

a) The

colour picture of the passport must be clear

b) The

copy for the front page and the copy for the back page must be

on the same side of the colour copy.

c) The

notary's stamp, signature, and seal must be legible

Only

if the candidate has a valid PTIN can he or she apply for the

Special Enrollment Examination (SEE).

The Special Enrollment Examination (SEE) is run by Prometric on

behalf of the IRS.

Each part has 100 questions with

multiple choices that must be answered in 3.5 hours. The test

can be taken in any order, depending on how well the candidate

has prepared. After candidates finish one part, they have three

years to finish the other two parts.

Candidate can check the updates in the prometric website who

monitor the EA examination.

https://www.prometric.com/test-takers/search/irs