Institute of Management Accountants (IMA)

Global Finance &

Accounting profession

Trainers with corporate experience

400+ hours of pre-recorded class and self-learning platform

12 – 700 days of

completion period

Student Scholarships(CMA along with University degree)

700+ hours of blended live training (Online / offline)

Learn with your recruiters

Placement Training and Internship Opportunity

2 Part Exams

12 Competencies

US CMA is a globally recognised, advance credential

appropriate for accountants and finance professionals.

June 5, 2024

June 19, 2024

June 10, 2024

June 24, 2024

June 12, 2024

Working Professional Batch

15% External Financial Reporting Decisions

20% Planning, Budgeting, and Forecasting

20% Performance Management

15% Cost Management

15% Internal Controls

15% Technology and Analytics

20% Financial Statement Analysis

20% Corporate Finance

25% Decision Analysis

10% Risk Management

10% Investment Decisions

15% Professional Ethics

4 hours – 100 multiple-choice questions &

two 30-minute essays

4 hours – 100 multiple-choice questions &

two 30-minute essays

1st January to 28th February

Last Date of Registration: 15th February

Exam Results (January Exams): 15th March

Exam Results (February Exams): 15th April

1st May to 30th June

Last Date of Registration: 15th June

Exam Results (January Exams): 15th July

Exam Results (February Exams): 15th August

1st September to 28th October

Last Date of Registration: 15th October

Exam Results (January Exams): 15th November

Exam Results (February Exams): 15th December

You must meet each prerequisite listed below in order to be qualified for CMA Professional certification:

IMA® (Institute of Management Accountants) is one of the largest

and most respected associations focused exclusively on advancing

the management accounting profession. IMA offers its members

exclusive access to the CMA program. We are committed to helping

you – and our network of more than 100,000+ members – to expand

your professional skills, better manage your organization, and

enhance your career.

Visit imanet.org/cma-certification to apply. You

will need to purchase the CMA entrance fee and IMA membership.

The application process takes about 10 minutes.

Register

for the exam. You can register for Part 1 and Part 2 in any

order or register for both at the same time.

Prepare

to complete certification requirements including submitting your

education transcript and work experience. This can be done

before or after passing the exam but is required as a final step

to become certified.

Membership in IMA®.

Entrance into the CMA

program.

Completion of Part 1 and Part 2 of the CMA

exam.

Bachelor’s degree from an accredited college or

university or an equivalent degree as determined by an

independent evaluation agency.

Two continuous years

of professional experience in management accounting or financial

management.

Join IMA

Pay the CMA Certification Entrance Fee

Register

for the CMA exam by paying the exam fee

Receive a

Registration acknowledgment form which provides your

authorization number(s), testing window(s), the Instructions for

Candidates, and access to the CMA Exam Support Package.

Schedule

your exam appointment(s) with Prometric.

Select the

best CMA review course for self-study or take our Online

Instructor-Led Course.

Appear for your scheduled exam

appointment(s) with the required identification documents.

The CMA exams are computer-based and administered at hundreds of

Prometric testing facilities worldwide. With three testing

windows each year, you can sit for an exam at a time and place

convenient for you.

If you are enrolled in the CMA

program and are ready to sit for the exam, here are the

steps:

Pick your testing window. Testing windows are

offered in January/February, May/June, and September/October.

Register

for the exam at www.imaonlinestore.com/

Receive your authorization number(s)

along with

further instructions.

Schedule your exam

appointment(s) with Prometric, our testing partner, at

www.prometric.com/icma

ICMA® (Institute of Certified Management Accountants) is the

certification affiliate of IMA. ICMA is responsible for

developing, administering, and grading the CMA (Certified

Management Accountant) exam; establishing the policies and

procedures for the CMA program; and for ensuring the program’s

overall integrity. The ICMA Board of Regents is responsible for

setting policies, and the ICMA staff is responsible for

operations.

All CMA candidates have three years to pass Part 1 and Part 2 of

the exam. The time period will begin with the date of your entry

into the CMA program. In case if you are unable to clear the

paper within 3 years then you will have to start from the

scratch i.e. pay once again all the fees and prepare well. Also

remember in this three year if you qualify only one paper, post

expiration of your entrance fee will result the passed paper

invalid.

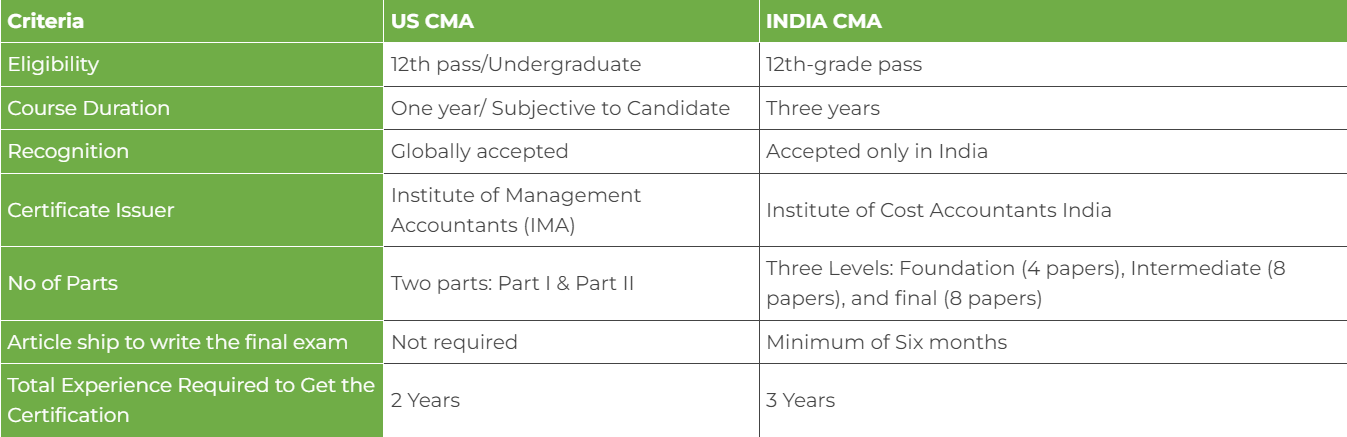

CMA USA certification is issued by the Institute of Management

Accountants (IMA) whereas CMA India certification is issued by

the Institute of Cost Accountants for India. Here are the key

differences between CMA USA and CMA India.

In

comparison of the key features, it is no brainer that CMA USA

certification is superior to CMA India certification in terms of

credibility, exposure, opportunities or pay scale.

US CMA is a prestigious financial certification in all

industries and companies. As per reports, the demand for US CMA

professionals in companies has been on an upward trend for the

past two years.

Companies have been hiring US CMA

professionals for job roles like Financial Accountant, Analyst,

Investment Banker, Internal Auditor, and Budget Analyst. Even

the Big4 finance companies have been hiring US CMA professionals

left and right in many job titles with high pay.

Completing

your US CMA course opens doors to plenty of career

opportunities. Candidates can select their desired job based on

their long-term, and short-term goals and salary.

A certified management accountant (CMA) is a professional who

helps businesses manage their finances and make strategic

decisions. CMAs work with financial statements, budgeting, and

forecasting. They also develop cost-saving strategies and help

businesses make well-informed decisions about where to allocate

their resources.

Both qualifications have their advantages and disadvantages. CA

is generally seen as being more difficult to obtain than CMA.

The process is longer, and there are more exams to pass.

However, this is offset by the fact that CA is widely recognized

and highly respected.

CA is also more focused on

accounting, tax and audit, while CMA is more focused on cost

management and analysis. So it depends on your specific

circumstances and goals.

You have to complete a bachelor's degree in accounting or a

related field. Once you have your degree, you'll need to

pass the CMA Exam, which is administered by the Institute of

Management Accountants (IMA). The CMA Exam is a two-part exam

that covers financial accounting and reporting, as well as

strategic management accounting. After passing the exam,

you'll need to complete a CMA internship before you can

earn your CMA designation.